Predatory financing can also make version of car loans, sub-perfect money, family guarantee money, tax refund anticipation fund or whatever individual debtmon predatory credit strategies are weak to reveal recommendations, disclosing false information, risk-depending costs, and you may excessive costs and you may costs. These methods, sometimes directly otherwise when combined, perform a pattern regarding financial obligation that triggers big monetaray hardship having parents and individuals.

You’ve got choices

If you’re facing personal debt difficulties, you could think this type of lenders are your own simply option. Not true-you may have enough choice so you can taking out advance loan payday loan near me a top-costs financing:

- Payment plan with loan providers-An informed replacement for payday loans is to price privately which have the debt. Exercising an extended commission package along with your financial institutions can get succeed one to pay-off their unpaid debts over longer of time.

- Progress out of your workplace-Your boss may be able to grant you an income progress inside an emergency state. Since this is a true advance rather than financing, there will be no notice.

- Borrowing union mortgage-Credit unions normally promote sensible brief small-title money to help you users. Instead of cash advance, these types of fund give you a bona fide possible opportunity to pay-off which have lengthened pay attacks, lower rates, and installment payments.

- Credit rating guidance-There are many credit counseling enterprises regarding Us that may help you work-out a personal debt fees plan that have creditors and create a spending plan. These services are available at the almost no rates. The brand new Federal Foundation to have Credit Counseling (nfcc.org) is a good nonprofit business that will help you see a reputable official credit rating counselor near you.

- Crisis Assistance Apps-Of several society communities and trust-created groups offer crisis assistance, possibly truly otherwise owing to social qualities applications for climate-related emergencies.

- Payday loans on your charge card-Credit card cash advances, being always offered by an annual percentage rate (APR) regarding 29% otherwise less, tend to be less expensive than getting a quick payday loan. Some credit card companies focus on customers having economic problems or poor credit records. You really need to shop around, and do not believe that you do not qualify for a credit cards

Fundamentally, you need to know that you’re in control, even if you end up for the financial difficulties. There are numerous choice to quit highest-prices credit of predatory loan providers. Make sure to talk about your options.

All of the lenders must opinion your information just before granting a loan

Was this post useful? Visit the Its A funds Procedure website for more quick clips and you can helpful blogs so you’re able to add up of money, one to question at a time! Evaluate straight back, the newest subjects could be delivered regularly.

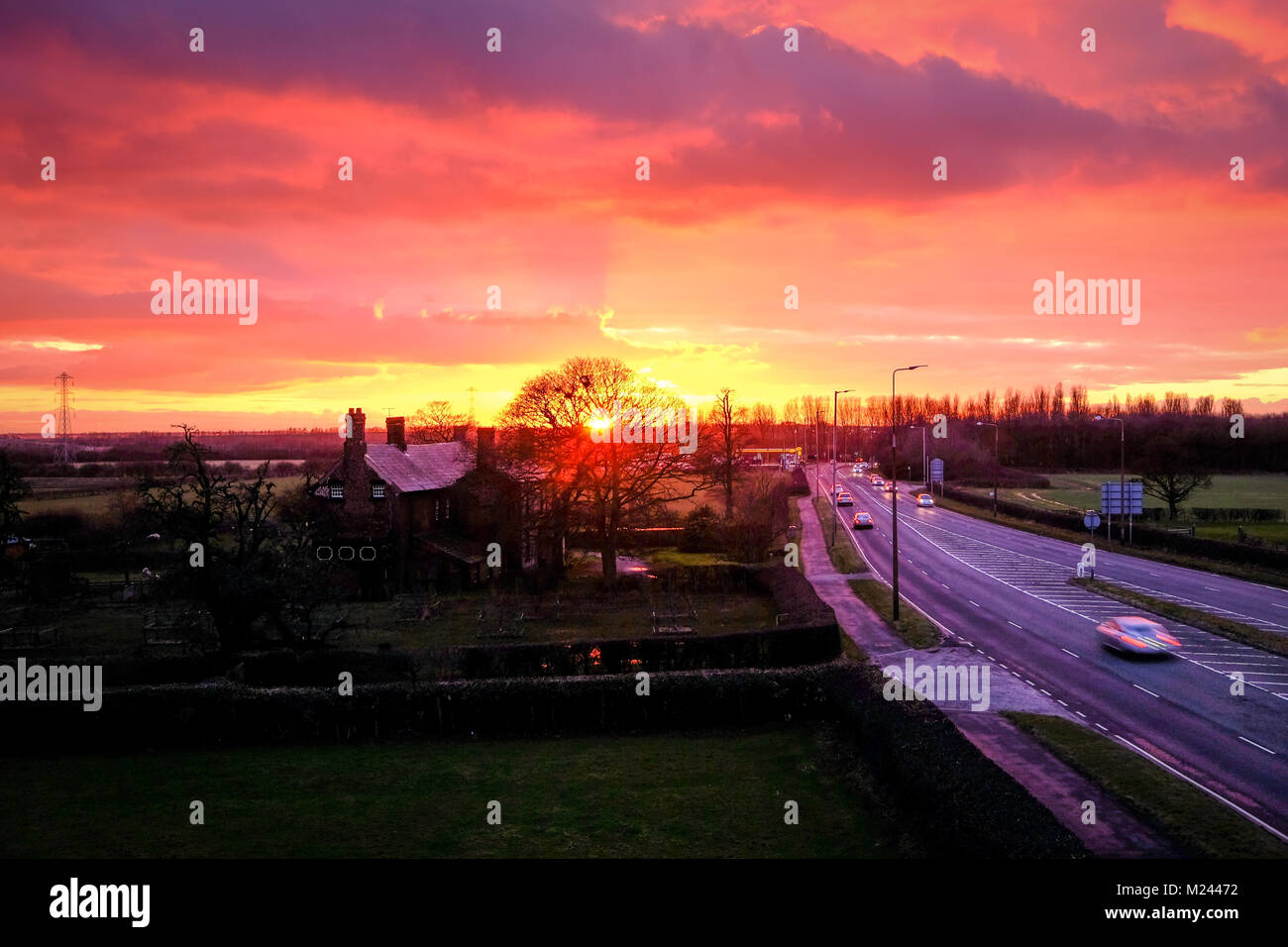

Run down and you may vacant domiciles ? brand new unavoidable consequence of predatory financing ? wreck havoc on neighborhoods. Possessions thinking slip. Some one disperse aside. After strong areas begin to break, next crumble. Something that has been so essential having more and more people lays from inside the ruins. People just who lived in a location destroyed from the predatory lending gets a victim.

Aggressive solicitations. Did people sell to you personally? Keep clear out of anybody who concerned you trying to sell you financing. If you need that loan, comparison shop because of it yourself.

Balloon Repayments – A familiar predatory habit is to offer good bower that loan that have straight down monthly payments having a giant commission due at the end of one’s loan name. Fundamentally, a balloon fee is over two times the latest loan’s average payment, and often it may be tens and thousands of bucks. A couple of times this type of balloon payments are hidden about deal and sometimes connect individuals of the amaze.

If you are given a loan toward pledge beforehand that you are guaranteed to end up being acknowledged, getting really mindful. When you’re offered financing no downpayment, be sure you understand the terms of the mortgage including whether or not there will be a first financing and a second mortgage having some other costs whenever you will be required to buy home loan insurance rates?

Just like the predatory financing are secured personal loans, the lending company enjoys something to get in case your borrower defaults. Very, by tricking a person on taking out financing for a good house they can not afford, a loan provider will receive repayments to possess a period and next get the possessions back during property foreclosure market it to have money.

- Loan sharks try some one otherwise teams exactly who give fund at extremely large rates. The word usually refers to illegal activity, but could and additionally relate to predatory lending pursuits like pay check or term money. Financing sharks possibly demand installment by the blackmail otherwise threats from violence.