Instead, individuals had been analyzed for an EHLP mortgage when you are one system is actually ultimately

- the resident was able to afford the home loan repayments in advance of the job losings,

Alternatively, people were analyzed to possess an enthusiastic EHLP mortgage while one program is in place

- the latest citizen has collateral in the home that may serve as equity on the bridge loan, and

Alternatively, individuals was analyzed to own an EHLP financing if you are one to system was in place

- new homeowner possess a reasonable prospect of reemployment at the a living next to that of the last job.

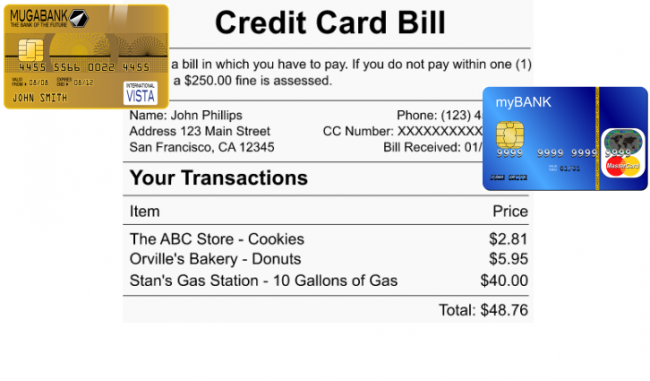

The original criterion together with pertains to individuals making an application for UI. The following is going to be ascertained because of the taking a look at the homeowner’s financial percentage background to your one-year ahead of the business losses. The third criterion can be determined by evaluating the current mortgage equilibrium (in the latest financial charging declaration) having an estimate of the home worthy of. As part of the app, the new resident will be required to have a copy of one’s latest mortgage charging you statement. It seems the modern equilibrium for the home loan and title of your own servicer. The presence of people second liens into the assets will likely be ascertained in the credit file. Appraisals can be used to influence the modern worth of getting for every single software. Rather, to store to the assessment fees, the official could use an automated valuation means (AVM) generate a price of your own homeowner’s per cent security, and you can follow through which have an appraisal on condition that the newest AVM ways a reduced or bad security status.

In cases like this, the state perform basically feel making a consumer loan

An important aspect of HEMAP’s assessment process are researching brand new resident according to last standard-the brand new reemployment applicant. For the Pennsylvania, this is done on a personalized base. Says starting this new software could embrace eg something. Instead, they may compromise certain reliability getting abilities and you can legs its analysis on the earnings official certification they currently demand for their UI program. Whilst not a perfect substitute for an individualized comment, which UI earnings decide to try perform make it possible to identify people who possess better reemployment applicants. The benefit once again should be to power current info.

In the current housing industry, probably the central issue is how to help a negative equity citizen exactly who qualifies to possess a link loan. The application form framework would need to equilibrium the fresh questioned benefits to the fresh resident, and also the wider neighborhood, out of getting guidance contrary to the questioned will set you back so you’re able to taxpayers regarding default to your loan. Given that a debtor who may have forgotten their job and you can keeps bad collateral is a leading standard risk, and foreclosed house usually offer at the a serious disregard, brand new servicer could have a powerful extra to consent.

Says can make their bridge funds conditional on specific concession by lenders, such as a temporary reduction in monthly installments. However, there would be a swap-off right here, since making the connection mortgage conditional on lender concessions-hence HEMAP doesn’t do-may likely sluggish adoption of your system also lengthen the loan recognition techniques. A much better method is to need broader concessions by the large lenders-for instance, for the maintenance criteria-as part of a deal within production of connection loan software, in place of to get https://paydayloanalabama.com/morrison-crossroads/ concessions to the a loan-by-mortgage foundation.

Credit so you’re able to a thoroughly processed selection of underemployed individuals would be a profitable technique for claims to aid upset property owners, eliminate financially unproductive foreclosures, which help balance out domestic charges for the benefit of people most importantly. This process hinders the newest complexity at work with servicers adjust mortgage words. Where variations are required also, the prospect away from a bridge loan you certainly will give a reward having servicers to do something.

While you are there are many benefits to setting-up these mortgage apps in the the official level, a switch issue is simple tips to loans new programs through the episodes regarding rigorous county finances. Such as for instance, since , HEMAP prevented and then make the fresh finance because of faster county funding. Continuity out of system money could be accomplished by enabling says to obtain on the government to cover investment openings during attacks when condition fiscal restrictions is actually binding.